Have you ever wondered where exactly your money is going? They say that money doesn’t grow on trees, but it sure feels like it can grow wings and fly away. If you don’t keep an eye on exactly where your money is going, then you’ll notice that you’ll soon have less and less of it as time goes on. In this case, personal finance software is a must-have to keep your finances in check.

Just grabbing a piece of paper and writing down every dollar you spend isn’t enough motivation to control your personal finances. Your expenses and investments need to be broken down into exact categories. You have fixed expenses like your house rent and car insurance, as well as unfixed expenses which tend to vary such as groceries and entertainment.

Are You Equipped with the Right Tools?

Personal finance software gives you the chance to be your own accountant. They are usually very easy to understand for beginners. The right software will help you gain insight into your spending habits. Are you going to Starbucks more than your budget will allow? Are you losing your balance when it comes to investing in the stock market?

Use Services Like Mint to Stay Organized

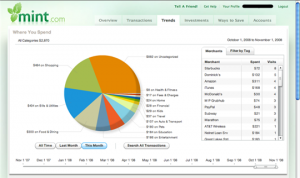

There are handy online solutions such as Mint, which can help you visualize how your money is being spent and where you need to allocate money properly to have a balanced budget. Mint is very handy at giving you the birds-eye-view of your finances, across all of your accounts in 1 easy to digest screen.

Not only will personal finance software such as Mint help you see where modifications need to be made in your spending habits, but it will also help you keep track of your taxes, 401K,investments, and income. To further assist you in making wise investments, finance software should give you the latest information on old and new tax laws in addition to stock reviews.

Staying on top of your investments can be time-consuming and overwhelming. Provided in the personal finance software are reports that update you on each of your investments. It will tell you the numbers involved, so you’ll see if the investment is doing well or if it’s time to shift where you are putting your money. Some of the software out there will even put you on alert if there is a down-shift or improvement in your stocks.

It’s also imperative that your bank accounts are properly managed. Since most of us are “visual” in nature, you’ll love the way this software can put your finances and spending habits in the form of a line graph or pie chart. As they say, a picture is worth a thousand words.

Utilize Auto Bill Pay Features

Do you sometimes forget to pay your bills on time? It’s easier to remember when you’ll reap the benefits of your investments or when the paycheck is due. However, it’s not as easy or fun to keep track of when to pay that over-priced doctor’s visit or paying for your annual car inspection. For this reason, a very convenient feature that these various programs offer is the ability to schedule all of your bill payments.

In addition to having smart software that can help manage your finances properly, there are also debt resolution services such as Project Debt Relief that can assist in bringing your finances back in the black.

Are you having trouble making ends meet? Do you live beyond your means, but not understand why? Are you spending more than you are actually making? Would you like to set aside money each month for emergencies or a dream vacation? Then, be sure to check out some of the financial software that exists online today to get your finances in order.